- Half Baked

- Posts

- Business ideas #247: 23andme for X, E-waste...

Business ideas #247: 23andme for X, E-waste...

Plus How an Autoimmune Disease Led to an $8bn Business

Welcome to Half Baked, the newsletter serving up business ideas as valuable as Juan Soto’s new record-breaking deal with the Mets ⚾️

Here’s what we’ve got for you today:

Business Idea💡: Taking 23andMe’s model (kinda) to a new area

Drunk Business Idea 🍻: Making finance gurus put their money where their mouth is

Just The Tip 📈: The crisis technology is making worse

The Moneyshot 🤑: How an autoimmune disease led to an $8bn business

P.S: If you want to read any previous editions of Half Baked you can on our website and if you were forwarded this email you can subscribe here.

P.P.S: Half Baked is free. Half Baked will always be free. That’s thanks to the support of our sponsors. We’d love if you could take a moment to check them out. It helps to keep the ideas flowing and our landlords from kicking us out 😬

Let’s get into it.

BUSINESS IDEA | VENTURE STARTUP

23andMe for Water 💧

Testing the waters

Available Domain: H2Optics.io

💡 TLDR: A platform which allows users to understand and test the water quality in their area and take steps to improve their water quality

1. Problem/Opportunity❓

The Problem/Opportunity: Water quality is a constant topic of discussion these days. Take RFK Junior’s pledge to remove fluoride from water supplies across US. Or remember during the Olympics when the water quality in the Seine was a huge problem? Thankfully those fears were completely unfounded.

We’re all becoming more aware of how water quality affects our health and wellbeing. So why not jump on this trend and build a gigantic business? Here’s the plan.

Market Size: The global water testing and analysis market is valued at approximately $4.7 billion (2023) and is expected to grow at a CAGR of 5.8% through 2030.

2. Solution ✅

The Idea: A platform which allows users to understand and test the water quality in their area and take steps to improve their water quality

How it Works:

A users signs up to the platform and gives details about where they live

Based on where they live the user can get access to data on water quality in the area (this data is publicly available in the USA by request, you just need to aggregate it)

Customers can then order their own water testing kits from the site to get more detailed breakdowns of the water quality in their area

Based on the results the user gets recommendations on products like water filters they should buy to improve their water quality

Go-to-market: The path to market here is to create an app aggregating the publicly available water quality information and partner with water testing companies and filter companies through affiliate deals. Then over time develop your own water testing and filtration systems which you sell to customers.

Business Model: One-time charge for the app, affiliate revenue for referrals for testing kits and filters, then charge for testing kits and filters in the future

Startup Costs: You could spin up an app here with a few thousand dollars. If you want to go all out from day one and offer all of these services you’ll need to raise money

3. How You’ll Get Rich 💰

Exit Strategy: The goal here is to get acquired by a health testing company like LetsGetChecked

Exit Multiple: This is a mixture of hardware and software making it hard to get an exact multiple, but 6-8x revenue is probably a good range here

TOGETHER WITH OMNISEND

The Most Boring Marketing Tactic

Let’s be real.

Email marketing is not the “sexiest” member of the marketing family.

And that’s okay. As a business owner, you have enough “exciting” stuff happening.

Who wants more excitement when you can have stable and effective instead?

Let’s be boring, in the best way possible.

Brands using Omnisend on average make $73 for every $1 spent using their all-in-one e-commerce marketing platform.

No need to learn anything new here. A platform so boringly intuitive, it’s like you designed it yourself.

No venturing into the great unknown. Their support team is available 24/7 to make sure you don’t have any unwanted adventures.

Use code HALFBAKED10 & get 10% off your first 3 months.

For new paid plans only, expires Dec. 31, 2024

DRUNK BUSINESS IDEA

Bank Balance Social Network

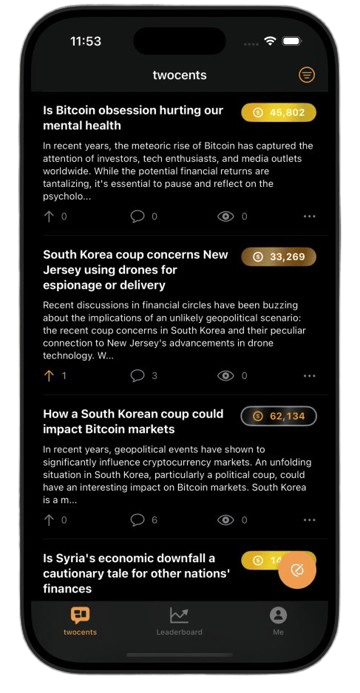

The internet is full of unsolicited financial advice. But how do you know who to trust and who to ignore? It’s simple. Their bank balance.

Which is why on this social network for finance advice there are no usernames. Instead of usernames everyone’s name is their bank balance, so you know exactly how much you can trust their advice.

Genius.

JUST THE TIP

Trend 📈: E-waste

There are 7.2 billion phones and 2.7 billion computers around the world, not to mention all the other digital products we buy and have to eventually throw out. And while its great that advanced technology has become so widely available, this leads to a lot of e-waste. In 2022 62 million tonnes of e-waste was produced, up 82% from 2010 and it’s on track to hit 82 million tonnes. E-waste is terrible for the environment and these devices contain really valuable parts and precious metals that are sitting in scrapheaps around the world. So let’s build some businesses in this space.

Business Ideas

E-Waste Marketplace Platform: Create an online platform connecting e-waste generators with recyclers or manufacturers who use components of e-waste as inputs into their production processes

Electronics Refurbishment Business: Purchase used electronics in bulk from businesses/institutions and repair and refurbish devices to resell at competitive prices

TOGETHER WITH MASTERWORKS

Invest with the art investment platform with 23 profitable exits.

How has the art investing platform Masterworks been able to realize an individual profit for investors with each of its 23 exits to date?

Here’s an example: an exited Banksy was offered to investors at $1.039 million and internally appraised at the same value after acquisition. As Banksy’s market took off, Masterworks received an offer of $1.5 million from a private collector, resulting in 32% net annualized return for investors in the offering.

Every artwork performs differently — but with 3 illustrative sales (that were held for 1+ year), Masterworks investors realized net annualized returns of 17.6%, 17.8%, and 21.5%.

Masterworks takes care of the heavy lifting: from buying the paintings, to storing them, to selling them for you (no art experience required).

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

THE MONEYSHOT

How an Autoimmune Disease Led to an $8bn Business

Epictetus, the Greek stoic philosopher, famously said “it's not what happens to you, but how you react to it, that matters.”

And this founder, who turned his autoimmune illness into an $8bn business in just 2 years, is the embodiment of this idea.

This is his story.

You might say that Johnny Boufarhat is a citizen of the world.

He was born in Sydney, Australia, but his early education was from the Dubai American Academy in…you guessed it…Dubai. As a teenager he moved to the UK and Johnny went on to study engineering at the University of Manchester.

After finishing his degree in 2016 Johnny had the itch to explore even more of the world, so he went traveling in South East Asia with his girlfriend at the time. But while Johnny was travelling disaster struck. He contracted a rare bug which left him immuno-suppressed. The condition persisted for over a year, during which time Johnny was nauseous, tired and barely left his apartment in London. His entire life was turned upside down left Johnny feeling empty and alone.

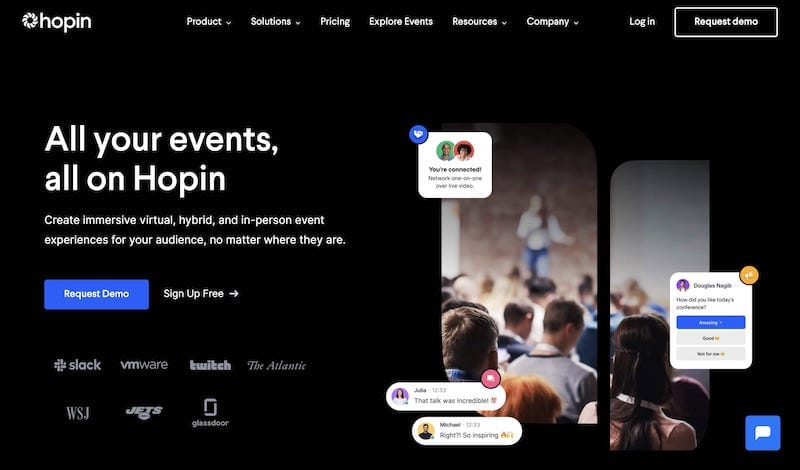

Over time, through drastic diet changes, he managed to regain some of his strength which he channelled into solving his own problem. While he was sick Johnny really missed going to events. He wondered if someone could create an online platform which captured the magic of in-person events online. He started coding the platform himself in 2019 from his London apartment.

By February 2020 he was ready to launch it.

He founded Hopin.

Johnny’s timing could not have been better. Covid was sweeping across the world and everyone knew that events would have to move online going forward. This enabled Johnny to raise $6.5 million in a seed round in February/March 2020 to help support the growth of the platform.

Throughout 2020 the company completed two more raises in June and November, raising $40 and $125m across those two rounds. By the end of 202 revenue had hit $20m ARR. Hopin was the hottest startup in Silicon Valley at the time.

To keep growth going Hopin decided to acquire Streamyard for $250m in January 2021, adding a huge amount of revenue to their topline. By March 2021 ARR hit $70 million and Hopin raised a $400 million Series C at a $5.65 billion that month.

ARR blew past $100m in August 2021 and around this time the company raised a $450 million Series D round which valued the company at $7.75bn. The company was less than two years old and was worth $8bn, one of the fastest run-ups in Silicon Valley history. In fact Hopin had become the fastest SaaS company to reach $100 million in ARR ever.

But despite outward appearances all was not as it seemed. Sure Hopin had grown revenue quickly, but almost half of the revenue came from the Streamyard, not their core revenue channels which was starting to slow as covid lockdowns started to recede. By 2022 the market had cooled a lot and Hopin was left trying to jutify its sky-high valuation. Couple this with the fact that Johnny had been selling a lot of his shares to cash in on the Hopin mania. Between July 2020 and March 2021 Johnny sold shares worth between $150m and $180m. Not bad for a two years work…

By 2023 the company was on the brink of collapse and the company sold its events unit assets, including its technology, customers and engineering and product teams, to RingCentral for just $15 million in August 2023, with Johnny resigning at the time. The company continued to operate its live-streaming and video hosting products (Streamyard and Streamable) until April 2024 when they sold these products to the “Berkshire Hathaway of Mobile Apps”, a company we’ll talk about another day.

In the end though what’s the big takeaway from Johnny’s story? Timing is everything? The faster they rise the harder they fall? Secure the bag while you can?

Well I think the biggest lesson comes back to what Epictetus said. It’s not about that happens to you, it’s about how you react. Johnny took the worst thing that ever happened to him and it inspired him to build a business that changed his life forever.

So the next time you’re faced with adversity, whether it’s today, tomorrow or far in the future remember…it’s all about how you react.

1 - 1 FOUNDER FEEDBACK

We Need Your Help

We're on a mission to become the world's #1 entrepreneurship newsletter, but to do that we need your help. Got feedback, ideas, or thoughts on what you’d love to see next? This is your chance to help shape Half Baked. Darragh (our Head Baker) is opening up his calendar just for you. Click here to book a 15 minute call.

Have a Business Idea?

Get feedback on it from the Half Baked team

Send us an outline of your business idea and we'll get back to you with our thoughts on it. We won't share your idea anywhere, this is 100% confidential. We just want to do our bit to help our readers to start badass businesses!

Fan Feedback

Rate Today’s Edition

What did you think of today's edition? |

Your brand wants customers.

Our particularly attractive audience wants to hear about cool products.

We want to be able to pay our rent.

Let’s dance.

Reach out to us here to talk about sponsoring the newsletter!

Reply